Since 2007, the University Venture Development Fund (UVDF) has helped to convert the research conducted at Oregon’s public universities into new businesses while providing student experiential education. Over the last six years universities have raised nearly $8 million from private sources to transfer new technologies developed at university labs into commercially viable products and startup companies. It is an important tool for moving innovations out of the lab and into the economy.

Later this week, the legislature will vote on whether to re-approve funding for the UVDF.

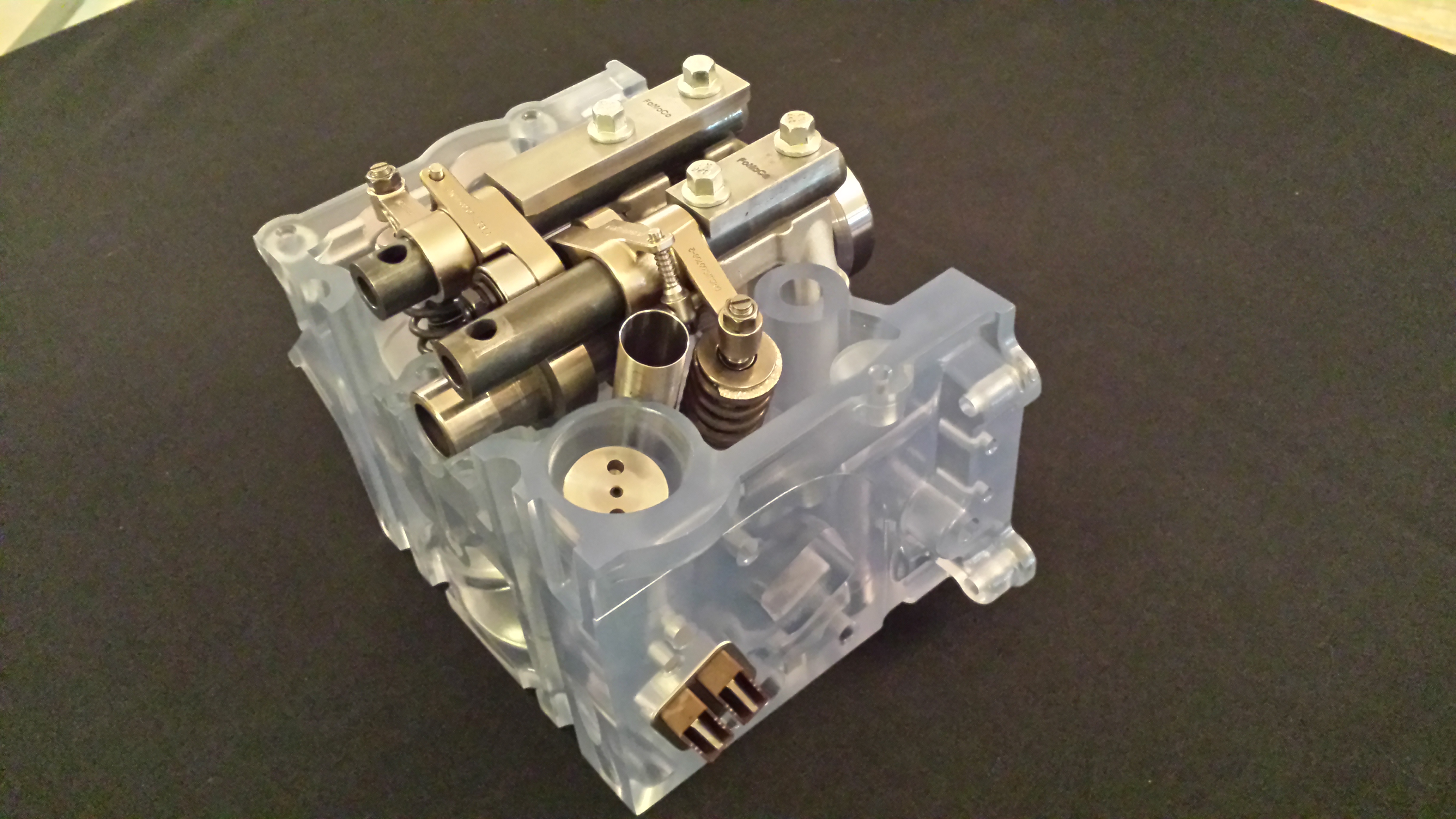

Concepts and companies from Oregon State University’s use of UVDF represent a wide range of STEM technologies and innovations. Onboard Dynamics is one such company who seeks to lower fuel costs and carbon emissions by removing barriers to driving natural gas-powered vehicles. Its product line integrates natural gas compression into cars and trucks, allowing drivers to refuel from any low pressure natural gas supply line. Founded in 2013, Onboard Dynamics is based in Bend, Oregon, and continues to grow several patents.

This new technology was on display last year at the first ever White House Demo Day. Onboard Dynamics has received financial support from the U.S. Department of Energy, ONAMI (Oregon Nanoscience and Microtechnologies Institute), Oregon BEST, and OSU, as well as strategic partners and private investors. The company’s first commercial products will be available later this year and already they’re seeing massive growth. And they’re not alone.

New companies supported by the tax credit have created approximately 270 high wage jobs that generate $1.45 million in annual tax revenues to Oregon. Total revenues generated over the last five years are estimated at $4.35 million. The UVDF tax credit is unique among all state tax credits because, in addition to generating new income taxes, universities repay the state treasury with revenues generated by successful companies. This feature has resulted in $581,547 being returned to the state.

The Request for the 2016 Session: Oregon’s public universities are requesting the legislature to:

- Extend the same tax credit amount ($8.4 million) authorized by the legislature in 2007 for another six years to 2022. (This amount is half that requested during the 2015 legislative session.) This will enable the universities to make use of the remaining $4.2 million to raise an additional $7 million.

- Enable donors to use a flexible schedule to claim the credit in 1-3 years, rather than requiring them to divvy the credit equally over three years. When taxpayers contribute to the UVDF, they don’t know whether they will benefit from the credit over the next three years. This enables them to claim the entire credit during the first year. This action does not increase the state’s total exposure beyond the $8.4 million limitation. It simply accelerates the time available to individuals to claim the credit.

Proof that UVDF works:

- The UVDF has helped launch 27 companies.

- These companies have created approximately 270 high wage jobs that have returned an estimated $1.45 million in annual taxes to Oregon, for a total of $4.35 million in revenues over the last five years.

- Every year the UVDF remains available, Oregon universities will directly support the launch of new startups, and help many more become successful through university and community-based accelerators.

- Over 750 students have received training on real-world case studies with support from the UVDF.

- At least 7 new entrepreneurial programs, supporting real world educational experiences have been supported and/or established with funding from the UVDF.

- 54 projects have been provided proof-of-concept funding resulting in at least 30 products and services currently in commercial development.